Condo Insurance in and around Wilmington

Wilmington! Look no further for condo insurance

Protect your condo the smart way

Home Is Where Your Condo Is

Often, your haven is where you are most able to take it easy and enjoy family and friends. That's one reason why your condo means so much to you.

Wilmington! Look no further for condo insurance

Protect your condo the smart way

Why Condo Owners In Wilmington Choose State Farm

That’s why you need State Farm Condo Unitowners Insurance. Agent Brian Teti can roll out the welcome mat to help generate a plan for your particular situation. You’ll feel right at home with Agent Brian Teti, with a hassle-free experience to get reliable coverage for your condo unitowners insurance needs. Personalized care and service like this is what sets State Farm apart from the rest. Agent Brian Teti can help you file your claim whenever the unforeseen lands on your doorstep. Home can be a sweet place to be with State Farm Condominium Unitowners Insurance.

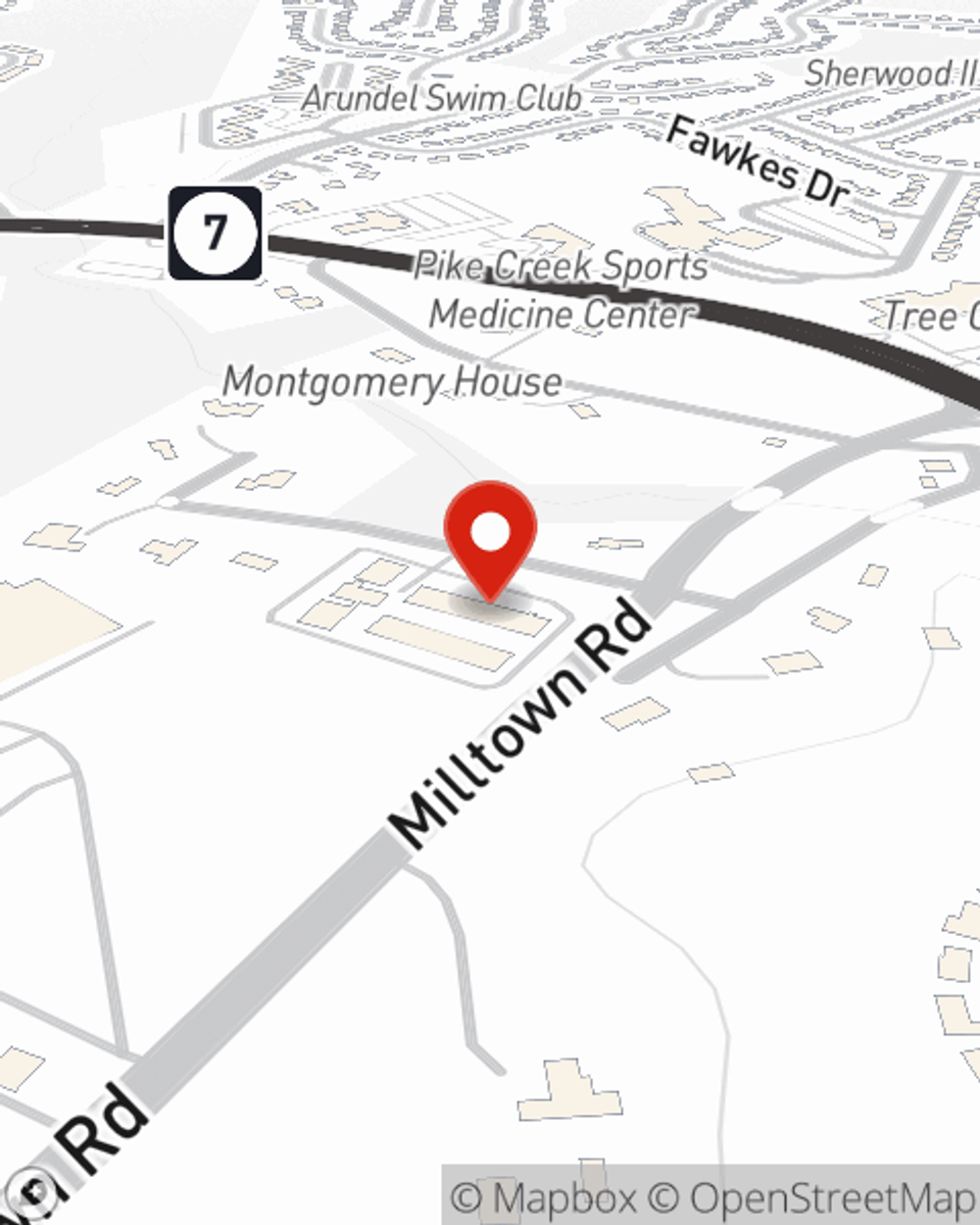

When your Wilmington, DE, condo is insured by State Farm, even if the unexpected happens, State Farm can help protect your one of your most valuable assets! Call or go online now and see how State Farm agent Brian Teti can help meet your condo unitowners insurance needs.

Have More Questions About Condo Unitowners Insurance?

Call Brian at (302) 999-9984 or visit our FAQ page.

Simple Insights®

Home safety checklist

Home safety checklist

Consider these home safety measures to help prevent common household injuries.

How to get rid of bed bugs

How to get rid of bed bugs

Learn about potential ways to spot bed bugs and what you can do to get rid of them before they spread throughout your home.

Simple Insights®

Home safety checklist

Home safety checklist

Consider these home safety measures to help prevent common household injuries.

How to get rid of bed bugs

How to get rid of bed bugs

Learn about potential ways to spot bed bugs and what you can do to get rid of them before they spread throughout your home.